A personal guide to evaluate and invest in web3 projects

This article was written for people with a basic understanding of Web3 in mind. Complete beginners may find this guide useful to look up resources. I am probably not the best person to ask for advice, as I am nor an expert nor a financial advisor. This article is based on my personal experience and should not be taken as financial advice.

As someone who spends more time than I should on Twitter / 𝕏, I come across numerous new crypto projects attempting to generate FOMO. A common question I receive is: What are your thoughts on X coin? Will Y experience a surge during the bull market? I used to be the one posing these questions, and as everyone in that ecosystem knew, I made some rather questionable investment decisions. However, these mistakes can be easily avoided, and it all boils down to assessing risk. In traditional finance (TradFi), I believe it is easier to evaluate risk because in every market, risk is closely linked to value and utility, which can be challenging for newcomers to assess in the crypto space. Therefore, here is my brief guide to discovering the next big thing and constructing a risk-efficient portfolio in the medium term.

Rule 1: Invest in what you understand

Before you invest a single dollar in cryptocurrencies, ask yourself:

- What problem does Bitcoin solve? Hint: Do you trust a third party for payments?

- What is the difference between FIAT (Dollars or Euro) and Bitcoin? Hint: Who controls Bitcoin? Who controls traditional currencies?

- What is the difference between Bitcoin and Ethereum?

Those questions are super basic for anybody in the ecosystem, yet many investors can't answer them, mostly because they see cryptocurrencies as speculative bubbles. This is not true in the TradFi world. If you invest in Tesla, I'm pretty sure you have a good understanding of their business model, what electric cars are for, and probably a dozen other facts about the company.

While it seems like a basic tip, trust me, it's worth understanding an asset before investing in it, even if you miss the wave. Because if you catch this wave at the wrong time, you will (1) lose your money and (2) not be prepared for the next one.

Rule 2: Developers are the customers

One key mistake is to think that the blockchain will be a consumer product. The average human being has never heard of SWIFT, yet they might be using it. Same goes with most blockchain projects, yet many investors still believe that in 10 years, we will be buying our groceries in $ETH. This will never happen.

Blockchain is a fantastic global state machine that will eventually serve as the backbone of the global payment system. You should view it as an infrastructure solution. Currently, we pay in Euros or Dollars, not in VisaCoin or MasterCardToken. There is no reason why we cannot continue in this direction. How can we differentiate between projects if none of them will be consumer products? Developer experience.

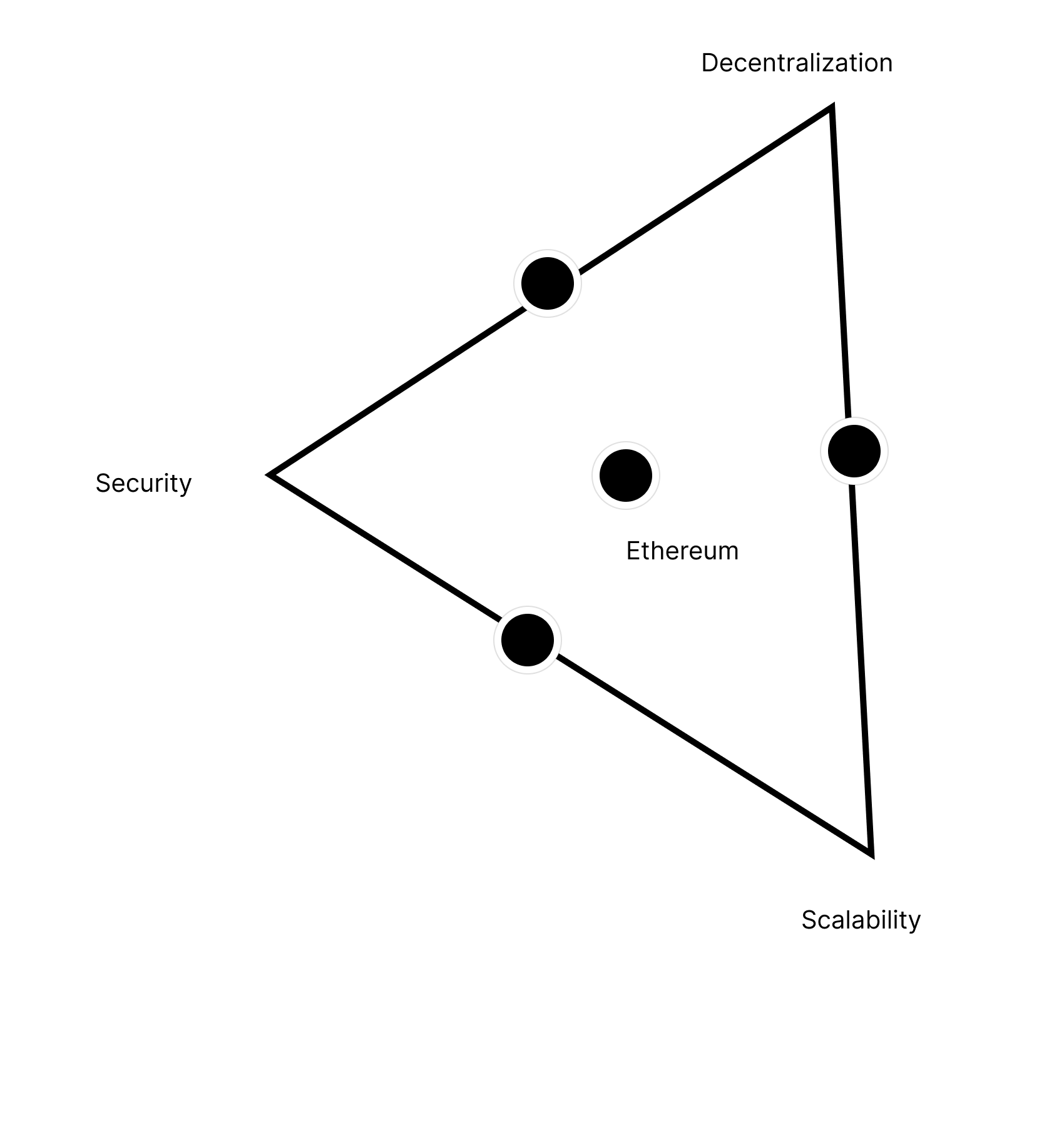

Today, the absolute gold standard is Ethereum. It's the first mainstream fully programmable blockchain, and it is by far the most resilient. The main advantage of Ethereum is that it leads the path when it comes to solving the blockchain trilemmna:

Good at everything, master at none.

Just like Bitcoin, Ethereum is a Layer 1. It's the category of chains used to develop and secure all decentralized applications (dApps). Before that, we can find Layer 0s that focus on interoperability and provide communication frameworks for higher-level blockchains. Some examples include Avalanche, Polkadot, or Cosmos. Blockchains built on top of Layer 1s are called Layer 2s, and they provide additional capacity and features such as scalability and privacy. Some examples include Arbitrum, Stacks, or Polygon.

Understanding layers is fundamental because it will help you better understand what problem a blockchain project might be solving. But not every project in crypto is about infrastructure. Some projects like Chainlink or Uniswap are incredibly useful to both traders and developers. This latter one is often a determining factor for the success of a project.

The best technologies are the ones that you don't see, so you need developers. Today, when companies want to have a presence online, they typically build a website using tools like Next or React variants. Twenty years ago, PHP would have been the answer. Why this change? Developer experience. So how can we gauge DX, even as a non-developer?

- Technical documentation is more important than the whitepaper: Have you ever looked at Uniswap's whitepaper? I have, but it told me nothing that I cared about. On the other hand, the docs helped me build something on top of it. If the documentation makes you want to build, then the DX is probably good!

- Structure is more important than simplicity: If the examples are 5 lines of code for something that you require 200, then there is probably a catch. Abstraction is easy, but structure and control isn't. If the code you are looking at, is both controllable and make sense, then the DX is probably good!

- Reinventing the wheel comes at a very expensive cost: Let's take two Layer 1s as an example: Avalanche C-chain and Solana (yes, I said Avalanche was a Layer 0, but its C-chain built on top of it isn't). Avalanche works with EVM, the Ethereum standard. Which means that developers coming from Ethereum (the vast majority), already know everything they need to get started. On the other hand, Solana requires you to learn Rust. Rust isn't that bad, compared to what some chains do (looking at you Tezos), but it still has a learning curve. Today, Solana is probably more successful because of the lower fees and more innovative solution. But in my opinion, Avalanche will take the lead (in terms of volume & projects launched on it, not price), sooner or later. Because from a developer perspective, there is a lot more to build on Avalanche. Solana is still an asset I would have in my portfolio though!

- Real world applications: Today, there are very few applications to blockchain technology. But this is what innevitably will drive adoption. Bitcoin's lightning network in South America, Decentralized finance, tokenization, file storage, etc. are all very good examples of what drives an ecosystem. Even those stupid Apes (NFTs) create real value. Developer-oriented platforms help solve real-world problem and bring enormous value.

- Developers love blockchain principles: If a project is not decentralized enough or if it doesn't provide some kind of freedom, the project has a good chance of failing. Open-source is often a good sign of a project's health. If the code is on GitHub and other people besides the core team are contributing, it's a really good sign (if not a requirement).

Rule 3: You are not a VC

Venture capitalists are smart, but they also have a lot of money to burn. There are a lot of projects that looks cool, but I cannot think of a single use case for it. Let's take Bittensor for example. There is a lot to say about this project, but I think their light-paper summarize it very well: "Understanding Bittensor is difficult for the exact same reason that it is powerful". I'm sorry for anybody who worked hard on this project, but when I hear something like this from the founders, I want to open a 150x leveraged short position on their token. I am sure there is a simple way of explaining what they do (which is basically incentivising people to create AI), but they overcomplicated their solution. This is a very popular mistake being made by both off-chain and on-chain founders:

- Don't fall in love with the solution, fall in love with the problem. And when this happen, there are generally two reasons, either the founder is inexperienced (which I don't think in this case), or that the problem isn't that big of a deal.

- There is no reasons for you to be the first investors. You missed buying $BTC at 100$, so you are coming to a space with people knowing a lot more than you, there is statistically no chance to be in the first investors of the next big thing. So don't try to 100x your investment and focus on what's actually valuable now.

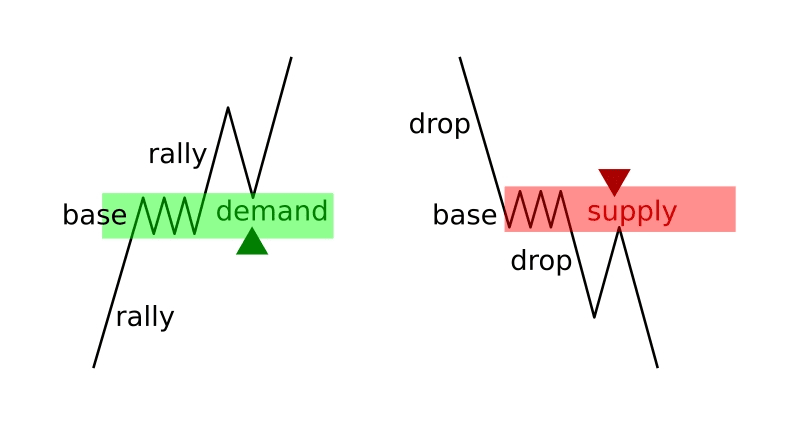

Rule 4: Market is easy, it's all offer and demand

Navigating the market is easier than it seems. For long trades, the concept is simple, buy when the supply is high and sell when the demand high. And that's where the "market psychology" comes in:

Navigating the market is easier than it seems. For long trades, the concept is simple, buy when the supply is high and sell when the demand high. And that's where the "market psychology" comes in:

That's why most people lose money on markets, it's because they arrive when everybody thinks the price is going up. There is a big demand, therefore prices indeed go up, but suddenly after, all the holders start selling and the market crashes.

That's why most people lose money on markets, it's because they arrive when everybody thinks the price is going up. There is a big demand, therefore prices indeed go up, but suddenly after, all the holders start selling and the market crashes.

On the otherside, it's really hard to invest when the price is low, because there is still a possibility for the price to go down even more (price is low -> no demand -> price goes down even more). In the crypto market, people tend to rely on Bitcoin and Ethereum a lot more during the bear market. A good signal may be when the retails (normal people) are out, but institutions are still in.

Conclusion

Investing successfully in crypto requires understanding the actual value proposition, focusing on projects with strong developer experience and real-world utility, avoiding overhyped "solutions" searching for a problem, and mastering market timing through study of market cycles and psychology.

Rather than chasing get-rich-quick schemes, build a balanced portfolio centered on projects you comprehend deeply, with robust codebases, clear product-market fit, and sensible tokenomics. Have the discipline to buy when others are fearful and sell into euphoria.

The crypto space remains highly speculative, but adhering to fundamental principles of risk management can help separate the signal from the noise and realize asymmetric returns. Stay humble, keep learning, and invest with conviction in what you understand.